Learning to manage your financial house is an important lesson to learn. It may seem overwhelming as you start looking at all the things you want to learn more about. To quote Confucius “A journey of a thousand miles begins with a single step” Here are some tips to get started.

Review your bills

Look for monthly automatic charges to your credit card or bank account that you are no longer using or getting any benefit from. These are often overlooked as small things, but they can add up quickly.

Finding little ways of saving can happen every day. Try walking to do some your errands or monitor the thermostat at home. Window shop and then plan your purchases, no impulse buys.

Finally, Look at your interest rates on your credit cards. You may have various levels of interest rates in your wallet. Transfer high-interest credit card balances to low interest ones first. Once you are maintaining low interest rates the next step is to commit to paying them off completely.

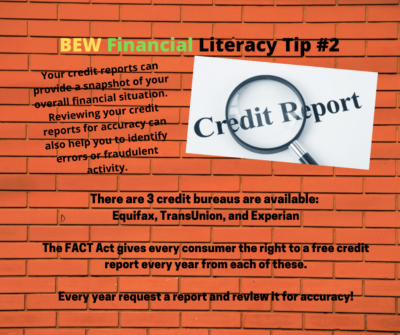

Credit Reports

A credit report is a detailed breakdown of an individual’s credit history prepared by a credit bureau. Credit bureaus collect financial information about individuals and create credit reports based on that information. Lenders also use the reports along with other details to determine your creditworthiness.

The three credit reporting agencies are TransUnion, Equifax, and Experian. Because of their reporting methods, it is common to have different credit scores across all three bureaus. All consumers should be aware of the FACT Act which gives the right to a free credit report every year from each of the credit agencies. All your credit reports can add a snapshot to your overall financial situation. Additionally, reviewing your credit report for accuracy can also help you to identify errors or fraudulent activity.

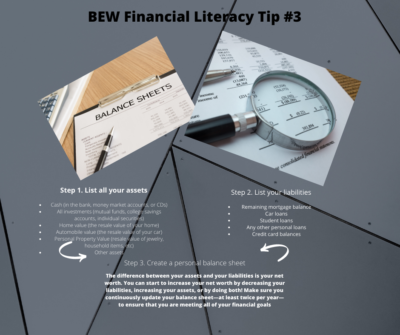

Create a budget

Bills and credit are parts of your finances. The whole picture can be seen by creating a budget. This can be broken down into 3 steps.

Step 1 List all your assets including but not limited to: Cash (in the bank, money market accounts, or CDS) All investments (mutual funds, college savings accounts, individual securities) Home value, Automobile value and any other assets you may own.

Step 2 List your liabilities including: Remaining mortgage balance, Car loans, Student loans, any other personal loans and credit card balances.

Step 3 Create a personal balance sheet. The difference between your assets and your liabilities is your net worth. You can start to increase your net worth by decreasing your liabilities, increasing your assets, or by doing both! Make sure your continuously update your balance sheet at least twice per year to ensure that you are meeting all your financial goals.

Setting goals

Now that you have a budget you are ready to set goals. Be sure every goal has a specific purpose, a dollar amount that it will cost, and a realistic target date. It is also important to make sure your goals are realistic and flexible, if your set them too high, frustration will set in and keep your from reaching your goals.

Goals can fall under different timelines. Short-term goals are priorities that can be accomplished within two years. Mid-term goals can be accomplished within two to five years. Finally Long-term financial goals may take more than five years to accomplish. Realize that you can prepare and plan a short-term goal like a family vacation or creating an emergency fund while planning for a home purchase or purchasing key insurance policies as a mid-term goal. The biggest of long-term goals usually involve retirement.

Bottom line is that you probably will not make perfect linear progress toward achieving goals. The important thing to remember is not to achieve perfection but to be consistent. Life is not perfect, and things may happen along the way. A car will break down or unfortunately there may be illness or job loss. To get through difficult periods you may have to change plans. This may mean you will put your plans on hold or create a new plan. That is the beauty of financial planning. You can review and update your goals and assess your progress in reaching them throughout life’s ups and downs. In the process, you will learn that the small things you do on a daily and monthly basis and the large things you do every year and over the decades will help you achieve your financial goals.